When your luxury vehicle is damaged in an accident, even if it’s repaired to perfection, it may never regain its full pre-accident market value. This loss is known as diminished value — and for vehicle owners in Maryland, it’s a real financial hit that often goes overlooked. DVAC recently worked with the owner of a 2022 Mercedes-Benz GLA250 who found themselves in exactly this position. The case underscores why a professional appraisal can make a major difference in your claim.

Vehicle Overview:

Model Year: 2022

Mileage at time of accident: 67,346

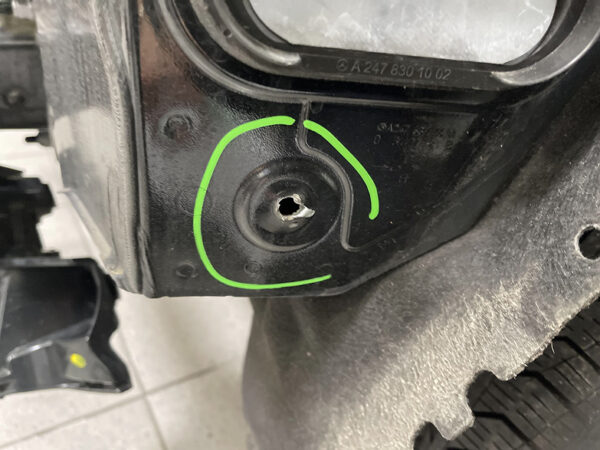

Damage Type: Rear-end and suspension damage

Reported by Carfax: “Minor damage” only (no mention of suspension damage)

Repair Total: $13,446.34

Diminished Value Calculated by DVAC: $4,450.00

The Carfax report on file failed to accurately reflect the severity of the damage, showing only a minor incident despite notable rear-end and mechanical issues including suspension repair. This misrepresentation can cause undervaluation — and missed compensation — without a proper third-party diminished value appraisal.

Why a Professional Diminished Value Appraisal Matters

Many insurance companies use generic formulas or lowball estimates to calculate diminished value, especially in Maryland, where diminished value laws can be complex and case-specific. In this case, DVAC performed a data-backed appraisal using J.D. Power, Kelley Blue Book, Black Book, MMR, and Carfax market comparisons to determine the fair diminished value. The result: an objective report concluding the vehicle lost $4,450 in resale value despite being repaired.

Had the owner relied solely on the insurance company’s offer, this loss might have gone entirely unrecognized.

The Problem with Inaccurate Carfax Reports

The Carfax for this 2022 Mercedes incorrectly described the accident as minor damage, failing to mention the structural and suspension work required. This kind of mislabeling can hurt resale value and complicate claims.

Many buyers trust Carfax during purchase decisions. If the report shows a history of damage — even without full detail — it reduces buyer confidence. And when the report downplays the severity, it may cause insurers to undervalue your claim. DVAC helps bridge that gap by clarifying what the actual market impact is using credible sources and valuation techniques.

DVAC’s Data-Driven Approach to Diminished Value

At DVAC, we go far beyond simple estimates. Our appraisers analyze:

Full repair documentation and receipts

Detailed market comparisons

Mileage and trim-adjusted values using J.D. Power and Black Book

CARFAX Market Reports and auction data

This full-spectrum analysis allowed us to calculate a real-world diminished value of $4,450, a number that closely aligned with broader market trends and the severity of damage.

And our turnaround is quick — clients typically receive full-service support and final reports in just a few days, ready to submit to insurers or attorneys.

Don’t Leave Money on the Table

If you’ve been in an accident in Maryland and your vehicle has been repaired, you could still be owed thousands in diminished value compensation. The case of this Mercedes GLA250 is one of many where DVAC helped a driver uncover the full financial impact of their loss — even when insurance companies or Carfax reports didn’t tell the full story.

Ready to find out how much compensation you might be missing?

Contact DVAC today for an objective, data-backed diminished value appraisal — and get the settlement you deserve.