Trust DVAC to

Recover the True Value of Your Vehicle.

Trust DVAC to

Recover the True Value of Your Vehicle.

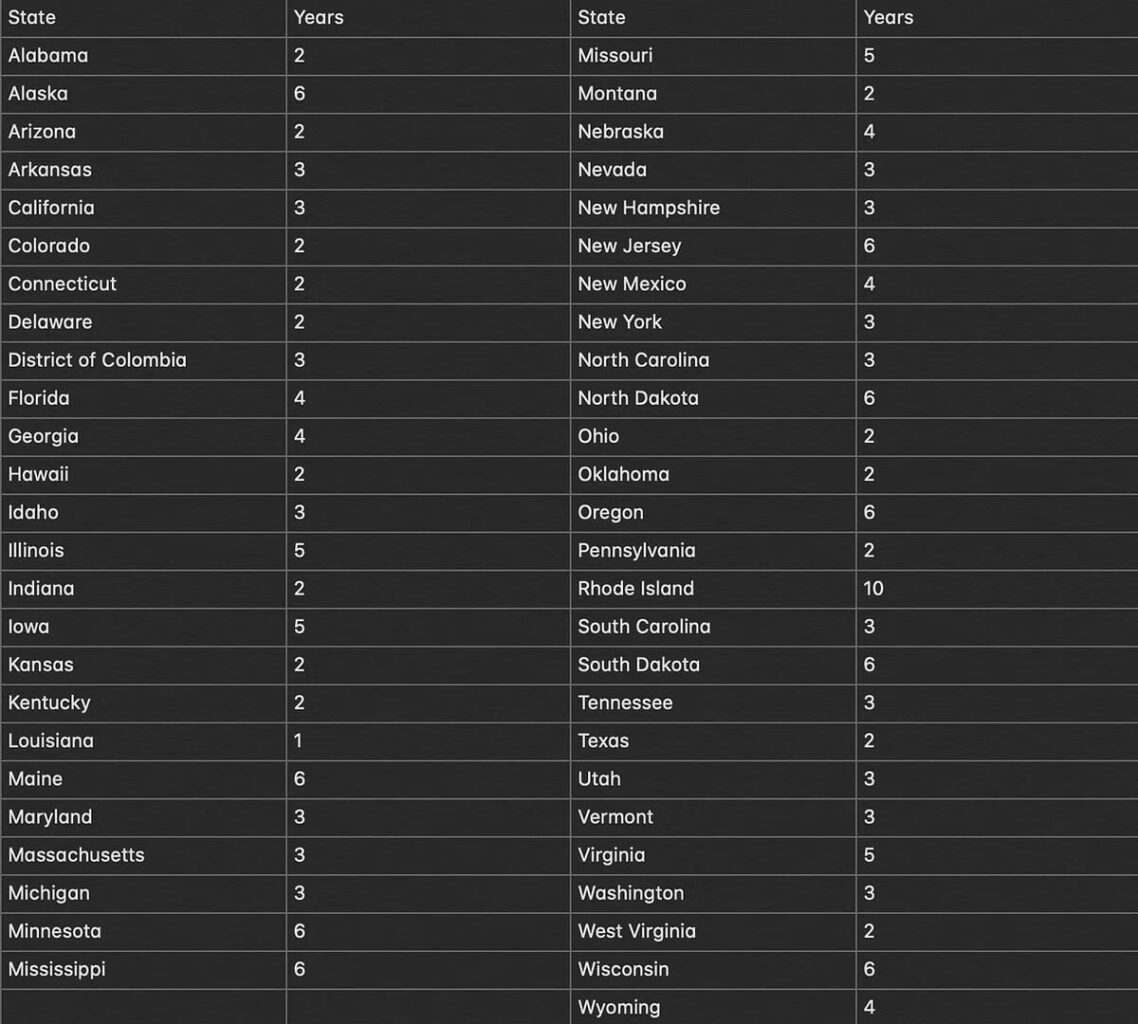

Statute of Limitations to File:

File First Party Claim:

File Third Party Claim:

Diminished Value Through Uninsured Motorist Coverage:

Small Claims Max Filling:

OUR PROVEN PROCESS

Start the process with a FREE consultation when you call us at (877) 879-0101 or fill out our Appraisal Form and we will contact you within minutes!

We analyze data to determine your vehicle’s true diminished value and deliver a quick, accurate appraisal that insurance companies can’t ignore.

We don’t stop at a report. We advise and support you through negotiations every step of the way until you receive your rightful compensation.

Experiencing a vehicle accident is a distressing event that can leave lasting effects. It’s crucial to handle the aftermath with composure and a clear plan of action to safeguard yourself and others involved. Whether it’s a minor bump or a major collision, understanding the steps to take can significantly impact your recovery process. In addition […]

Read More

Diminished value is recoverable in third-party cases and through your own uninsured motorist coverage. Minimum liability coverage is required and the statute of limitations to file a claim is 1 year from the date of the accident. (R.S.) 9:2800.17.

2011 Louisiana Laws

Revised Statutes

TITLE 9 — Civil code-ancillaries

RS 9:2800.17 — Liability for the diminution in the value of a damaged vehicle §2800.17.

Liability for the diminution in the value of a damaged vehicle:

Whenever a motor vehicle is damaged through the negligence of a third-party without being destroyed, and if the owner can prove by a preponderance of the evidence that, if the vehicle were repaired to its pre-loss condition, its fair market value would be less than its value before it was damaged, the owner of the damaged vehicle shall be entitled to recover as additional damages an amount equal to the diminution in the value of the vehicle. Notwithstanding, the total damages recovered by the owner shall not exceed the fair market value of the vehicle prior to when it was damaged, and the amount paid for the diminution of value shall be considered in determining whether a vehicle is a total loss pursuant to R.S. 32:702.

Even after repairs, your car may lose resale value due to its accident history—known as diminished value. Many buyers avoid damaged vehicles or expect a discount, but you have the right to file a diminished value claim. Some insurance companies won’t inform you of your right to an independent appraisal and often minimize payouts. With accurate data and a strong claim, DVAC ensures you get the compensation you deserve.

You should pursue a diminished value claim once your vehicle is fully repaired to pre-accident condition. Experts calculate diminished value based on the nature of the damage to your vehicle and overall evidence of repairs. A thorough review of the final bill from the bodyshop, a visual inspection of the vehicle after repairs, and a review of the Carfax are a few important factors in determining diminished value.

Recovering diminished value from the at-fault insurance company can take as little as a few days. However, some claims may take weeks—and in rare cases, months. The timeline depends entirely on the insurance company’s diminished value policy. One thing remains constant: DVAC will stay involved throughout your DOV claim, offering advice and support.

If your vehicle has been totaled in an accident, how do you determine a fair settlement? The insurance company has their figure, and you have yours. DVAC helps bridge that gap by guiding you to a realistic, mutually agreeable number backed by comprehensive market research. We compile a total loss report that includes all of our findings and your vehicle’s actual cash value.

We equip each diminished value appraisal report with a vAuto market analysis, NADA Archival Valuation, and a complimentary Carfax. vAuto captures 100% of all U.S. sales data for any vehicle. Using this powerful tool, we compile an extremely accurate pre-accident value and assess diminished value based on the nature of your vehicle’s repair records. We also include a detailed photo file and the final bill from the body shop. Once everything is compiled, we email you a comprehensive 20–30 page diminished value appraisal report.

The IRS requires a professional appraisal for any vehicle worth more than $5,000 if you want to claim a tax write-off. While vehicles under $5,000 don’t need an appraisal, we still recommend getting one to help avoid a potential audit.

Insurance companies rely on appraisals to determine the fair market value of your collectible vehicle. A certified appraisal from a licensed appraiser strengthens your claim and helps ensure the insurer pays you the full compensation you deserve in the event of a collision.

The requirements can vary depending on your lender. Some institutions may ask for an independent appraisal to verify the true market value of the vehicle you plan to purchase.

What about “Certified Used Vehicles”?

Many dealerships now offer “Certified Used Vehicles” on their lots, but each one sets its own policies and standards for certification. In many cases, dealers look closely for even minor damage history to disqualify your trade-in from meeting their “certified” criteria. As a result, they may offer you less than if your vehicle had a clean title. DVAC can help you recover that lost value through a diminished value claim.

If an accident has damaged your vehicle and you’re concerned about its true value, call DVAC Diminished Value Appraisal Claims at 877-879-0101 for a FREE consultation. If you’re ready to start the process, start your appraisal now! You can also check out our blog for more case-specific information.

Call DVAC at 877-879-0101 for a FREE consultation or Start your Appraisal now!