Diminished Value Settlement

We work diligently on your behalf to provide a fair and accurate automobile appraisal after an accident, helping you recover the diminished value of your vehicle.

A Collision Diminishes Your Car’s Value—We Help You Recover It

Even after repairs, your car may lose resale value due to its accident history—a loss known as diminished value. Many buyers avoid previously damaged vehicles or expect a significant discount. However, what most people don’t realize is that they can file a diminished value claim against the at-fault driver’s insurance.

Unfortunately, some insurance companies won’t tell you that you have the right to an independent automobile appraisal after an accident and often aim to minimize payouts. To secure the compensation you deserve, you need accurate data and a well-prepared claim. DVAC is here to help you recover what’s rightfully yours.

Initial DOV Offer

$500

With DVAC Services

$5,500

We’ll work diligently on your behalf to generate a fair automobile appraisal after an accident to help you recover your vehicles true value.

Do You Qualify?

If your vehicle was involved in an accident and has since been repaired, it may still have lost market value—even if the repairs were done flawlessly. This loss is known as diminished value, and a professional automobile appraisal after an accident can help determine how much compensation you may be entitled to. To qualify for a diminished value claim, your situation must meet the following criteria:

- BEEN IN ACCIDENT RECENTLY

- YOU ARE NOT AT FAULT

- VEHICLE REPAIRS ARE COMPLETE

- VEHICLE AGE MUST BE 5 YEARS OR LESS*

- DAMAGE MUST BE GREATER THAN $1500

OUR PROVEN PROCESS

How It Works

We provide an accurate diminished value automobile appraisal after an accident backed by trusted sources and insurance-approved methods. Our in-depth report includes real market data, ensuring a strong case for your claim. With expert guidance, we support you through negotiations until you secure the compensation you deserve.

1

Start Your Appraisal

Start the process with a FREE consultation when you call us at (877) 879-0101 or fill out our Appraisal Form and we will contact you within minutes!

2

Intake & Delivery

We analyze data to determine your vehicle’s true diminished value and deliver a quick, accurate appraisal that insurance companies can’t ignore.

3

End-to-End Support

We don’t stop at a report. We advise and support you through negotiations every step of the way until you receive your rightful compensation.

Real Reviews, Real Results

Edit:

Contacted Diminished Value Appraisal Claims 6months later for a consultation after receiving a repair estimate from the insurance company to ask about a diminished value claims. They kindly walked me through the details of what would warrant a diminished claim. My case did not qualify but I appreciate having the peace of mind. I would give them another 5 star rating if I could.

Sample Diminished Value Appraisal Report:

Wondering what’s in a DVAC appraisal? Take a look at this recent appraisal we completed for a client.

Frequently Asked Questions

When Should I File a Diminished Value Claim?

You should pursue a diminished value claim once your vehicle is fully repaired to pre-accident condition. Experts calculate diminished value based on the nature of the damage to your vehicle and overall evidence of repairs. A thorough review of the final bill from the bodyshop, a visual inspection of the vehicle after repairs, and a review of the Carfax are a few important factors in determining diminished value.

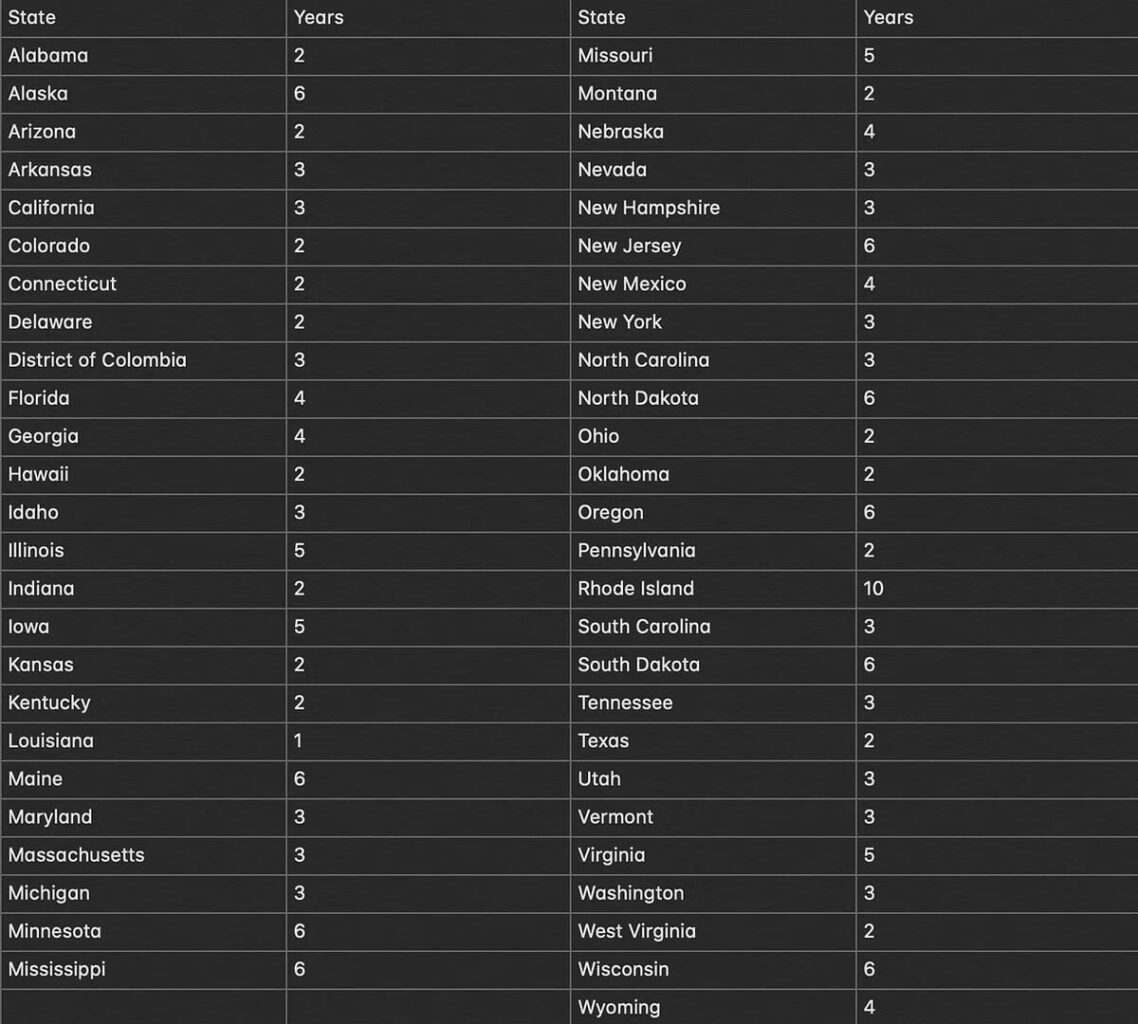

How Long Can I Wait To File a Diminished Value Claim? In Years..

How Long Does The Process of Recovering My Settlement Take?

Recovering diminished value from the at-fault insurance company can take as little as a few days. However, some claims may take weeks—and in rare cases, months. The timeline depends entirely on the insurance company’s diminished value policy. One thing remains constant: DVAC will stay involved throughout your DOV claim, offering advice and support.

What is a Total Loss Report?

If your vehicle has been totaled in an accident, how do you determine a fair settlement? The insurance company has their figure, and you have yours. DVAC helps bridge that gap by guiding you to a realistic, mutually agreeable number backed by comprehensive market research. We compile a total loss report that includes all of our findings and your vehicle’s actual cash value.

What's Included In My Report?

We equip each diminished value appraisal report with a vAuto market analysis, NADA Archival Valuation, and a complimentary Carfax. vAuto captures 100% of all U.S. sales data for any vehicle. Using this powerful tool, we compile an extremely accurate pre-accident value and assess diminished value based on the nature of your vehicle’s repair records. We also include a detailed photo file and the final bill from the body shop. Once everything is compiled, we email you a comprehensive 20–30 page diminished value appraisal report.

Do I need an appraisal if I plan to donate my vehicle?

The IRS requires a professional appraisal for any vehicle worth more than $5,000 if you want to claim a tax write-off. While vehicles under $5,000 don’t need an appraisal, we still recommend getting one to help avoid a potential audit.

Do I need an appraisal for my custom or collector car?

Insurance companies rely on appraisals to determine the fair market value of your collectible vehicle. A certified appraisal from a licensed appraiser strengthens your claim and helps ensure the insurer pays you the full compensation you deserve in the event of a collision.

Do I need an appraisal to purchase a vehicle?

The requirements can vary depending on your lender. Some institutions may ask for an independent appraisal to verify the true market value of the vehicle you plan to purchase.

What about “Certified Used Vehicles”?

Many dealerships now offer “Certified Used Vehicles” on their lots, but each one sets its own policies and standards for certification. In many cases, dealers look closely for even minor damage history to disqualify your trade-in from meeting their “certified” criteria. As a result, they may offer you less than if your vehicle had a clean title. DVAC can help you recover that lost value through a diminished value claim.

Been In An Auto Accident?

If an accident has damaged your vehicle and you’re concerned about its true value, call DVAC Diminished Value Appraisal Claims at 877-879-0101 for a FREE consultation. If you’re ready to start the process, start your appraisal now! You can also check out our blog for more case-specific information.

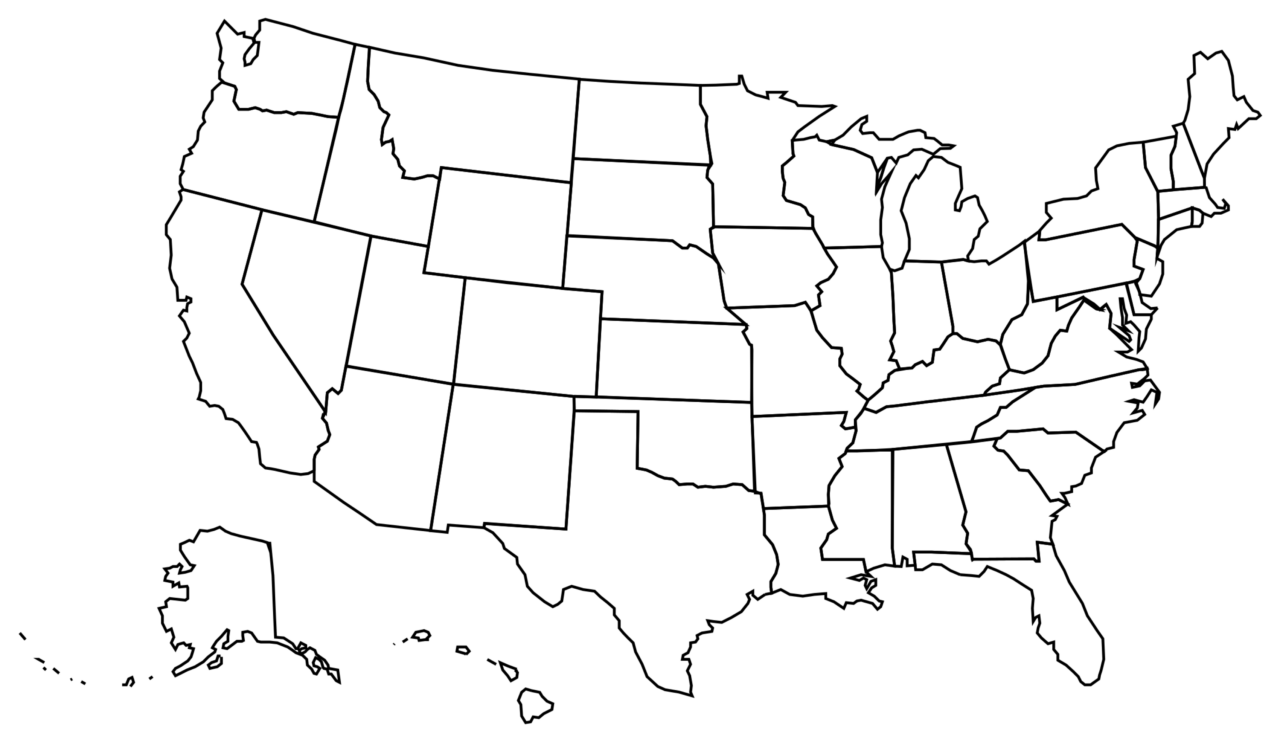

Learn About Diminished Value Laws In Your State

View all states

Understanding Diminished Value

If you’ve been involved in an auto accident it is very important to know your vehicles true value. You may be entitled to compensation from the at-fault party’s insurance company. Diminished value is the inherent loss of value resulting from a collision. Even though your vehicle is fixed and may appear 100%, it now has the collision and repair on its vehicle history. This can negatively impact resale value. Estimates reflect that over half of consumers would not purchase a vehicle that had been in an auto accident. Over 75% of consumers would not be willing to invest in a previously wrecked vehicle unless given a substantial discount.

Insurance companies usually will not inform you of your right to an independent appraisal

READ MORE

Despite this, some insurance companies won’t tell you that you have the right to seek compensation for diminished value. While they may say they’re on your side, their real goal is often to minimize what they pay out. This is why it’s essential to understand your rights and ensure your claim is presented properly.

You may be eligible for a diminished value settlement if:

- You’re not at fault

- Your vehicle is five years old or newer

- The damage exceeded $1,500.

- All repairs have been completed.

Types of Diminished Value:

1. Inherent: This type of diminished value occurs due to the perception that a vehicle with a history of accidents is less desirable than a similar vehicle with no such history, even if repairs have been carried out expertly.

2. Immediate: Immediate diminished value is the reduction in value that occurs immediately after an accident. It reflects the decrease in the vehicle’s worth due to the visible damage it has sustained.

3. Repair-Related: Repair-related diminished value occurs when repairs, although performed properly, are not sufficient to restore the vehicle to its pre-accident condition. In such cases, the vehicle may still have underlying issues that affect its value.

Factors Affecting Diminished Value:

Several factors can influence the extent of diminished value a vehicle experiences:

1. Severity of Damage: The extent of damage sustained by the vehicle in the accident plays a significant role. Vehicles with extensive damage typically experience higher levels of diminished value.

2. Vehicle Age and Mileage: Typically, older vehicles or those with high mileage may experience greater diminished value since they are perceived to have less remaining useful life.

3. Vehicle History:Even if repairs are complete, a history of accidents can still reduce your vehicle’s value. Many buyers, in fact, are hesitant to purchase cars with past damage.

4. Market Demand: The demand for a particular make and model in the used car market can affect its diminished value. Vehicles in high demand may experience less compared to those with lower demand.

How to Determine Diminished Value:

Determining a vehicle’s diminished value can be complex, but a professional appraisal often provides the clarity you need. There are several ways to assess diminished value, including:

1.Comparative Market Analysis: Comparing the value of similar vehicles with and without accident histories can provide insight into the diminished value.

2. Professional Appraisal: Hiring a professional appraiser experienced in assessing diminished value can provide a more accurate valuation.

3. Conclusion: Understanding the factors that contribute to diminished value and how to assess it accurately can help individuals make informed decisions when buying or selling a vehicle. Whether seeking compensation for diminished value after an accident or negotiating a fair price for a used car, awareness of this concept is essential for navigating the complexities of the automotive market.