Vehicle Donation & Tax Write-off

Protect your tax deduction with a professional, independent appraisal that ensures you receive the compensation you deserve.

Need an Appraisal for a Vehicle Donation or Tax Deduction?

If you’re donating a vehicle valued at $5,000 or more, the IRS requires an independent professional appraisal to claim your full tax deduction. While vehicles valued under $5,000 don’t legally require an appraisal, getting one is still recommended. It helps prevent discrepancies, ensures accurate valuation, and can protect you from potential IRS audits.

At DVAC, we provide certified vehicle appraisals along with the necessary IRS forms, ensuring you maximize your tax deduction and stay compliant with IRS guidelines. Don’t leave money on the table—get a professional appraisal and secure your full tax advantage today!

Maximize Your Tax Deduction with a Professional Appraisal

Your Personal Consultation will address:

- A comprehensive review of repair costs and estimates.

- An objective determination of whether your vehicle qualifies for diminished value or qualifies for a total loss settlement.

- An approximate range of compensation you may be paid for your loss.

Your Ultimate Guide: Tips for Buying a Vehicle

In the market for a new ride? Whether you’re a seasoned car buyer or a first-timer, purchasing a vehicle is a significant decision that requires careful consideration. To help you navigate the process smoothly, we’ve compiled a comprehensive guide with essential tips for buying a vehicle that meets your needs and fits your budget. Define Your Needs: Start by assessing your lifestyle, preferences, and budget. Consider factors like the number of passengers, fuel efficiency, cargo space, and desired features. This

Your Ultimate Guide: Tips for Buying a Vehicle

In the market for a new ride? Whether you’re a seasoned car buyer or a first-timer, purchasing a vehicle is a significant decision that requires careful consideration. To help you navigate the process smoothly, we’ve compiled a comprehensive guide with

Real Reviews, Real Results

Frequently Asked Questions

When Should I File a Diminished Value Claim?

You should pursue a diminished value claim once your vehicle is fully repaired to pre-accident condition. Experts calculate diminished value based on the nature of the damage to your vehicle and overall evidence of repairs. A thorough review of the final bill from the bodyshop, a visual inspection of the vehicle after repairs, and a review of the Carfax are a few important factors in determining diminished value.

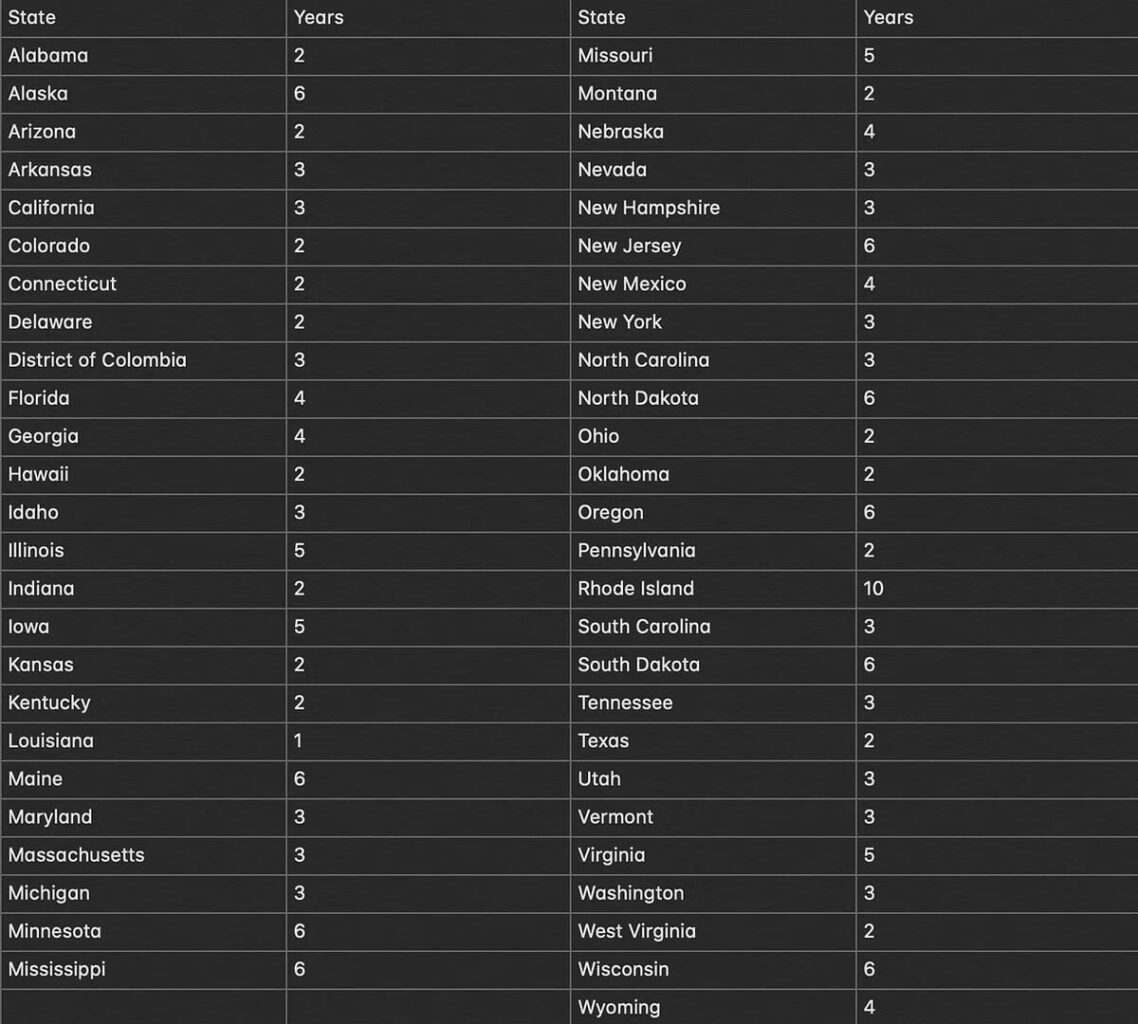

How Long Can I Wait To File a Diminished Value Claim? In Years..

How Long Does The Process of Recovering My Settlement Take?

Recovering diminished value from the at-fault insurance company can take as little as a few days. However, some claims may take weeks—and in rare cases, months. The timeline depends entirely on the insurance company’s diminished value policy. One thing remains constant: DVAC will stay involved throughout your DOV claim, offering advice and support.

What is a Total Loss Report?

If your vehicle has been totaled in an accident, how do you determine a fair settlement? The insurance company has their figure, and you have yours. DVAC helps bridge that gap by guiding you to a realistic, mutually agreeable number backed by comprehensive market research. We compile a total loss report that includes all of our findings and your vehicle’s actual cash value.

What's Included In My Report?

We equip each diminished value appraisal report with a vAuto market analysis, NADA Archival Valuation, and a complimentary Carfax. vAuto captures 100% of all U.S. sales data for any vehicle. Using this powerful tool, we compile an extremely accurate pre-accident value and assess diminished value based on the nature of your vehicle’s repair records. We also include a detailed photo file and the final bill from the body shop. Once everything is compiled, we email you a comprehensive 20–30 page diminished value appraisal report.

Do I need an appraisal if I plan to donate my vehicle?

The IRS requires a professional appraisal for any vehicle worth more than $5,000 if you want to claim a tax write-off. While vehicles under $5,000 don’t need an appraisal, we still recommend getting one to help avoid a potential audit.

Do I need an appraisal for my custom or collector car?

Insurance companies rely on appraisals to determine the fair market value of your collectible vehicle. A certified appraisal from a licensed appraiser strengthens your claim and helps ensure the insurer pays you the full compensation you deserve in the event of a collision.

Do I need an appraisal to purchase a vehicle?

The requirements can vary depending on your lender. Some institutions may ask for an independent appraisal to verify the true market value of the vehicle you plan to purchase.

What about “Certified Used Vehicles”?

Many dealerships now offer “Certified Used Vehicles” on their lots, but each one sets its own policies and standards for certification. In many cases, dealers look closely for even minor damage history to disqualify your trade-in from meeting their “certified” criteria. As a result, they may offer you less than if your vehicle had a clean title. DVAC can help you recover that lost value through a diminished value claim.

Been In An Auto Accident?

If an accident has damaged your vehicle and you’re concerned about its true value, call DVAC Diminished Value Appraisal Claims at 877-879-0101 for a FREE consultation. If you’re ready to start the process, start your appraisal now! You can also check out our blog for more case-specific information.

Start The Appraisal Process Now

Find out if you’re eligible for compensation with a quick and easy assessment.

No obligation required.

A+ Rating on BBB | Servicing Clients Nationwide