Diminished Value Appraisal for 2024 Ford Mustang GT in California

When a 2024 Ford Mustang GT was involved in a front-end accident in California, the vehicle’s owner turned to DVAC for an expert diminished value appraisal. Although the damage was considered minor, the impact on the car’s market value was significant—especially for a performance vehicle like the Mustang GT. Why Diminished Value Matters Many car […]

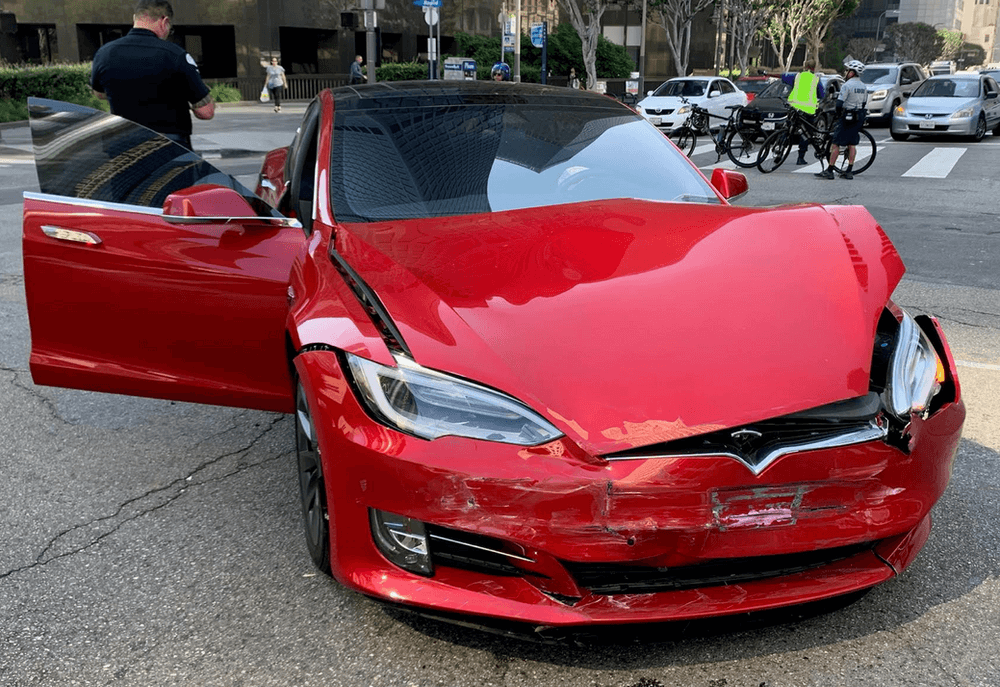

Car Accident Checklist: What To Do in 6 Steps

Hopefully, you’re never in a vehicle collision. However, even the safest drivers can’t avoid the unexpected. Below is our Car Accident Checklist in 6 easy steps. According to the National Highway Traffic Safety Administration (NHTSA), 5,930,496 automobile crashes happened in the U.S. in 2022. While some were minor fender-benders, others were severe wrecks causing fatalities. […]

GEICO’s Diminished Value Claim Process

Getting into a car accident can be stressful, as it often involves unexpected expenses, potential injuries, and loss of value, referred to as Diminished Value, of your vehicle. The loss of value can be one of those unexpected expenses that many overlook when filing a claim against the at-fault driver’s insurance company. If the at-fault […]

Navigating Boat Diminished Value Settlements after Damage

Whether cruising through tranquil waters or enjoying a day of fishing with friends, owning a boat can bring endless joy and adventure. However, accidents happen and when your beloved vessel sustains damage, navigating the process of seeking compensation can be daunting. One avenue, often overlooked, is diminished value settlements. Let’s explore what a boat diminished […]

The Importance of Vehicle Appraisal After an Accident: Protecting Your Investment and Ensuring Fair Compensation

An automobile accident can be a jarring and stressful experience, often leaving you with not only physical and emotional repercussions but also financial implications. Whether it’s a fender bender or a major collision, having your vehicle appraised after an accident is crucial. While it may seem like an additional hassle during an already challenging time, […]

Navigating the Aftermath: What to Do When You’re in a Vehicle Accident

Experiencing a vehicle accident is a distressing event that can leave lasting effects. It’s crucial to handle the aftermath with composure and a clear plan of action to safeguard yourself and others involved. Whether it’s a minor bump or a major collision, understanding the steps to take can significantly impact your recovery process. In addition […]

Diminished Value Case Study 2021 Toyota Tacoma

A client was recently involved in a wreck in his 2021 Toyota Tacoma TRD Off-road. His truck incurred just under $20,00o in damage restoration repairs. The vehicle sustained severe body/frame damage and underwent 2 hours of frame set up / 2 hours of chain pull to re-align the buckled frame. […]

Diminished Value: Do Your Homework

Ok, your vehicle has been damaged by an at fault insured driver. Once the at fault insurance company has accepted liability, you are ready to proceed. BTW, a deer running into your vehicle or other “acts of God” do not qualify for diminished value settlement. The key point here is that neither God nor the […]

Diminished Value: You Are Legally Entitled to it!

At fault insurance companies often make comical responses when it comes to Diminishment of Value (DOV) claims. I think my favorite is “you are a 3rd party so you can’t invoke the appraisal clause and compel us to settle your DOV claim”. This is after they have just paid for your damaged vehicle to be […]

Monkey in the Middle

Ok, you’ve just been in an accident that you were not at fault. Even though you could have your claim handled by the other person’s at fault insurance company you might want to have the claim handled by your own insurance carrier. Why? Do you want to be monkey in the middle on matters pertaining […]